At SCU, we’re With You! With You through every phase of your financial journeys, providing guidance and solutions that support you, your family, and our community.

Thank you for choosing Scott Credit Union! Below, you’ll find important information about your new SCU account, how to access easy and convenient online tools, services available to you as a valued member, and our commitment to supporting our communities. If you have any additional questions, please contact the SCU Member Contact Center.

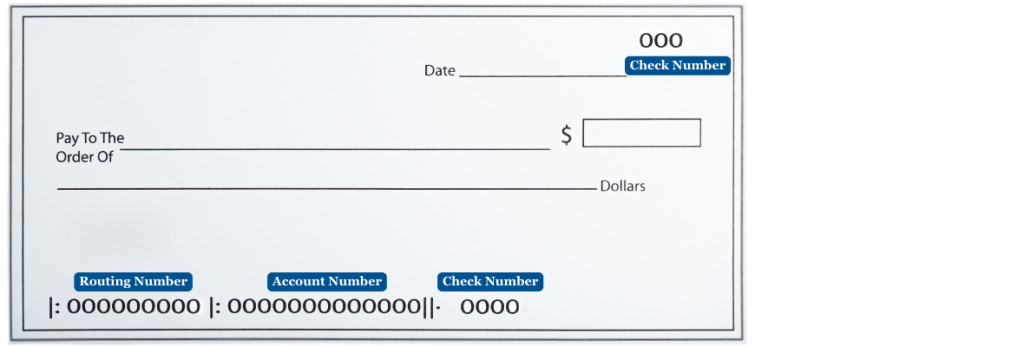

Your account number, also known as the MICR number, is located at the bottom of your checks. It is used for setting up direct deposits and automatic withdrawals from your accounts.

Your member number is a unique 7-digit number, which is also the last part of your account (MICR) number. This number is used to identify your account for online registration and for in-person transactions. This number can also be found under the “Details and Settings” tab of each account in Online and Mobile Banking.

281077522

Enjoy access to your free1 account anytime, anywhere, 24/7 on your computer or mobile device through our online services. You can view balances, see transaction history, deposit a check with Mobile Deposit, pay bills, or make a transfer.

1Your mobile service provider may charge Internet access fees. Web access is needed for SCU Mobile. Check with your service provider for details on specific fees and charges for mobile internet access.

We offer video tutorials on everything from online basics, setting up preferences, adding notifications and alerts, establishing automatic payments, and how to make your loan payment. You can also learn how to set up your online account and adjust your preferences.

The SCU blog covers a wide range of topics related to personal finance, banking, and credit union services. Whether you’re looking for budgeting and money saving tips, insights on how to protect yourself against scammers, guidance on managing your credit and more, our blog has you covered.

Your feedback is very important to us. We’d love to hear why you chose SCU and more about your experience in a Google review. Be sure to rate and review SCU in the St. Louis area or in the Chicago area.

Making loan payments at Scott Credit Union is easy and convenient.2 Here are the options available to you:

- Transfer funds from your Scott Credit Union checking or savings account to your Scott Credit Union loan using SCU Online or SCU Mobile.

- Make an online payment from your account at another financial institution by visiting our Payment Center. You can also set up convenient recurring ACH payment options.

- Stop by your local branch or any of the CO-OP Shared Branches to make a payment in-person.

- Pay over the phone using a debit card from an account at another financial institution by calling (800) 636-5465. (Please note that a $15 fee applies for this service).

2For vehicle loans, we do not charge a prepayment penalty. We do require that you keep comprehensive and collision (full) coverage on your auto with no more than a $1,000 deductible.

NCUA Insurance offers valuable protection for your deposits. It means that your total deposits at Scott Credit Union are federally insured by the National Credit Union Administration (NCUA) to at least $250,000.

Now you can get cash surcharge-free at more ATMs than ever. SCU members can visit any of nearly 30,000 ATMs that display the CO-OP logo. Whether you’re across town, or far from home, you’re never far from your money.

- Use surcharge-free ATMs at places like 7-Eleven®️, Circle K®️, Costco®️, Publix®️, Dunkin Donuts®️, and many regional convenience store locations.

- Locate an ATM wherever you are—through any of our easy locator tools, including phone, mobile app, text messaging or Internet

Find a surcharge-free ATM right now at co-opatm.org or call (888) 748-3266.

Look for the CO-OP logo at participating branches and ATMs. Learn more about how the CO-OP Shared ATM Network works.

Scott Credit Union Community Foundation

The Scott Credit Union Community Foundation is a 501(c)3 organization that focuses on education through scholarships and our very own With You grant program for local schools. The foundation also supports unbudgeted causes as needs arise within our communities. Discover more about our community foundation.

Community Involvement

Our employees love to give back! Our team is encouraged to volunteer at their favorite community or philanthropic events and earn rewards in the process. Plus, in celebration of our 80th year, we are committed to completing 80 Acts of Kindness in 2023. Check out our 80 Acts of Kindness as SCU employees plant trees, clean up local parks, donate supplies to a diaper bank, pay off school lunch debt, and more.

Community Partners

Founded at Scott Air Force Base, Scott Credit Union partners with military and veteran organizations as a priority focus of our community involvement. We also take pride in supporting first responders who protect our communities. Since 2008, Scott Credit Union has contributed nearly $3.9 million to support the communities we serve. Learn more about the organizations we support and our community partners.

Security Resources

At Scott Credit Union, one of our top priorities is to protect your money and your personal financial information. We need your help in this effort, so we created this page to give you tips on how to best protect yourself from fraud and scams as new technology becomes available. As technology continues to improve and become more sophisticated, so do the tactics through which criminals attempt to steal people’s identity and information. Debit card fraud also has become more prevalent. We have systems in place to detect fraudulent activity in an effort to minimize fraud on our members’ accounts.

However, we also feel it is important to arm all of our members with as much information as possible to help you protect your money and personal financial information from fraudsters. The following information includes details of current scams as well as information about how to best monitor your accounts for fraudulent activity. Please review the information so you can best protect your accounts and your personal information.

Related Blogs

How To Recognize And Protect Yourself From Scams

Q&A: What is a Fraud Ring and How Can I Keep Myself Safe?

Everything You Need to Know About Cybersecurity

Scam Alert: Don’t Get Caught in a Social Security Scam

Related Videos

If you have any questions, you can reach us through our live chat option or email. You can also call our Member Contact Center at (618) 345-1000. Our representatives are available Monday through Friday from 8 a.m. to 6 p.m. CST, and on Saturday from 9 a.m. to 1 p.m. CST. If you’d like to speak with a representative in-person, please visit any of our locations.